Overview

This project is to create a new API integration between CU*BASE teller tools to the Ascensus IRAdirect express™ web-based solution. This will be an optional, paid-for solution by credit unions who use Ascensus services for IRA reporting, tracking, and compliance tasks.

AVAILABLE NOW! If your credit union is interested in moving forward with the integration you can place an order directly in the Store.

The overall goal of this integration is to reduce dual entry for credit union employees. Currently when an employee opens a new account or posts certain member transactions in CU*BASE they must also enter them manually into the Ascensus IRAdirect site in order to complete related paperwork/forms. This project will pass data entered in CU*BASE over to the Ascensus wizard to eliminate manual rekeying.

The new interface is only needed in situations where a CU employee is actively handling a transaction and needs to generate special paperwork for the member to sign. The interface will not be triggered by any batch process (ACH, AFT, etc.) nor member-posted transactions (online banking, ARU, etc.)

Separate processes will be developed for new accounts, deposits, and withdrawals, since the data required is different.

View the slides from the 2023 Leadership Conference, held in Grand Rapids on June 20, 2023.

Project Scope

Features Included

- Account applications (acct opening) done via

- CU*BASE IRA Savings and IRA Certificate Account Creation (Tool #3)

- CU*BASE HSA Savings/Checking and HSA Certificate Account Creation (Tool #3)

- Contribution (deposit) and distribution (withdrawal) transactions posted via

- CU*BASE Standard Teller (Tool #1) and Xpress Teller (Tool #1600) posting platforms

Features Not Included

- Member Transfers posted via the standalone tool or Phone Operator

- Batch (non-interactive) transaction processes, such as ACH, AFT, etc.

- Transaction reversals or account adjustments

- Member-initiated self-service transaction processes, including online banking and audio response

- New accounts opened by the member via online banking

Other Caveats

- There will be no back and forth communication between CU*BASE and Ascensus beyond the initial push of data from the transaction just posted (or account just created) to the Ascensus wizard. Behind the scenes CU*BASE will have already returned to the starting point of whatever process the teller was doing, so that’s where the teller would end up once they exit the Ascensus wizard.

- Withdrawals that require withholding cannot be handled via this route at this time. When posting the withdrawal, the teller would bypass the link to Ascensus and proceed to post all withholding transactions the normal way, then log in to IRAdirect to enter both the withdrawal and withholding manually.

- Not all IRA/HSA post codes are supported by Ascensus; the system will not trigger the interface for any unsupported codes.

- New IRA/HSA savings accounts will be sent to Ascensus as an “application” (new account); there will be no verification as to whether there’s already an account under that plan for that member so the teller will need to follow any error instructions on the IRAdirect site.

- Note about opening a new IRA for a member and making the initial deposit – CU*BASE handles account opening independently from teller transactions like deposits or withdrawals. In the current integration there’s a delay on the Ascensus end to process a new account open before it is available to receive the first deposit transaction. So the way this is handled is that during the account opening process, the IRAdirect express system will allow input into the field for the initial deposit amount, allowing the application to be completed at that time. Tellers then need to return to CU*BASE and actually post that deposit in the usual way.

- New IRA/HSA certificate accounts will be sent to Ascensus as a deposit transaction on an existing IRA/HSA plan, not as a new account.

- If multiple transactions are posted with IRA/HSA post codes during the same transaction (such as if the member was depositing $100 into three different IRA savings suffixes, regardless of plan type), we will only send one of those transactions to Ascensus (the one with the lowest-numbered account suffix). Therefore we recommend each of those be handled as a separate posting transaction in CU*BASE teller processing, jumping out to Ascensus separately for each one.

- Batch processes already in place for sending data (twice a year, April and December, for 1099 and 5498 reporting) to Ascensus will be unchanged.

- This will be a paid-for service that a CU must request to be activated. Activation will require steps on the CU*BASE side as well as onboarding steps with Ascensus representatives.

General Workflow

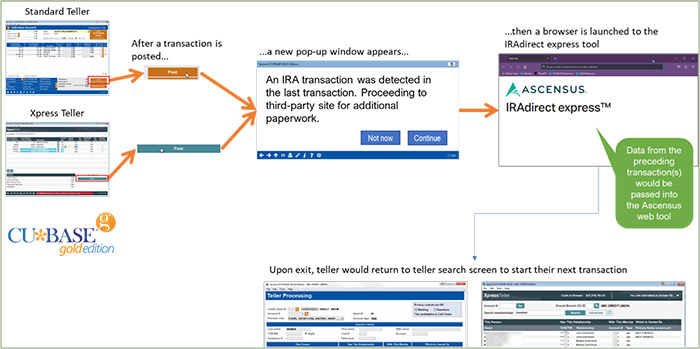

From Teller Posting

NOTE: Samples above show IRAs only, but similar changes will be made to the flow for posting transactions on HSA accounts.

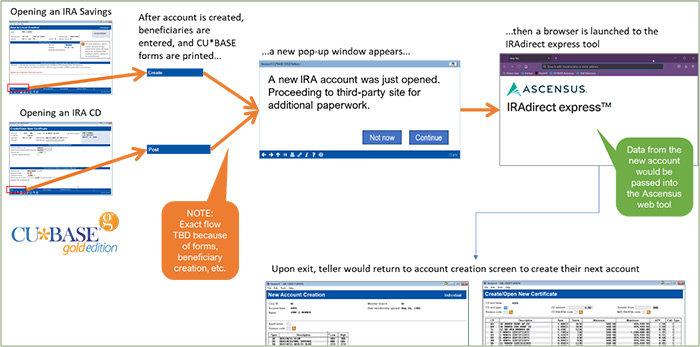

From Opening a New IRA Savings or Certificate Account

NOTE: Samples above show IRAs only, but similar changes will be made to the flow for opening HSA savings and certificate accounts, as well as when opening an HSA checking account.

Future Plans

Based on feedback from the beta-test, we are considering a future project to enhance the integration when it comes to how withholding is handled. This could perhaps be done by popping a window in CU*BASE to request an amount to be passed along to Ascensus through the integration, but used only for the purposes of completing the paperwork on the IRAdirect express system. The teller would still need to complete the withholding process in CU*BASE afterwards, as usual.

- Note: We do have on our long-term wish list to make this even more sophisticated in CU*BASE so that the posting could potentially be automated too, but for now this would allow for a short-term solution to work better for the Ascensus integration. Idea is still in the early design phases.

Your chef for this recipe: Keegan Daniel