All status updates below are as of February 2025.

Want to see 1Click offers in action? Check out the video showing the 1Click member experience!

What’s New with 1Click Offers

Check out the slides from the 2024 Leadership Conference!

1Click Limit Increase Offers

The idea is to allow the CU to vet a list of members eligible to receive a bump in the disbursement limit for an LOC or credit card, then use the 1Click engine to present that offer to the member in online banking. You would specify a maximum increase and members can accept that amount or a lower amount, sign whatever paperwork you want, and the system will automatically change the disbursement limit on the account.

Status: Specs are in process.

In the longer run, we also are thinking of using this idea as our first foray into automated decisioning via the Sync 1 decision model. The idea is just conceptual at this point, but we’re thinking that in addition to doing a vetted list, the credit union could also set up a standing offer for limit increases, presented via the new “Show my offers” feature that we’re building for the 1Click Relationship Offers project. This feature allows us to run an analysis on the member on the fly, and automatically present an offer if they qualify, eliminating the need for a static batch list of accounts. In this case we would run the Sync 1 decision model and present the offer based on a qualifying response.

Status: Design specs will start after we have completed the first phase (using the vetted list).

1Click Performance Dashboard(s)

We’re working on a multi-step plan for providing comprehensive performance stats on 1Click Offers. The goal is to answer the questions, “How are my 1Click campaigns going?” (such as # of offers made vs. # accepted) and “How are my 1Click loans performing?” (with delinquency and other servicing stats). Here’s how we’re attacking the goal:

- Create a new table specifically for 1-Click tracking, to log key data points every time a 1Click Offer is launched.

- Create a series of custom Queries using the new table, as prototypes for potential analysis tools.

- Design new CU*BASE dashboards using data from the new table, based on feedback from our prototype Queries.

Status: Project #64423, which creates the new tracking table and populates it with new 1Click offers, is in development. Once the data is available, the Asterisk Intelligence Team will then begin creating prototype analysis Queries, and we will begin design work on potential new analysis dashboards.

1Click Relationship Offers

(aka 1Click Offers Based on CLR Path Score)

This project will marry two of our most popular new internet retailing tools to allow you to make offers “on the fly” to members based on their current relationship with your credit union. In a nutshell, instead of creating an account list to determine who receives the 1Click offer, you’ll set up a CLR Path Decision Advisor score matrix, with score ranges and maximum offer amounts, such as:

- Score 400-500 = $750 max

- Score 501-600 = $1,000 max, etc.

When the member logs in, we’ll run a CLR Path score and present the offer for which they are qualified. The member just specifies the amount they want (up to the max allowed for their score), e-signs, and the account is opened!

Status: Project #62620 is currently awaiting QC testing.

1Click Pay Over Time Loan Offers

This is our twist on the new BNPL craze that everyone is buzzing about these days. Those programs rely on special arrangements with merchants (not really in our bailiwick). Instead, this program will be a variation on the 1Click Relationship Offers idea, where members who achieve a certain minimum score under your CLR Path program would be eligible for special “Pay Over Time” offers to cover recent purchases.

In this case the trigger for the offer would be a recent debit card purchase, over a certain dollar amount you specify, in the member’s accounts. When a member logs in to online banking the system will evaluate their CLR Path score for eligibility, then evaluate recent activity and offer an on-the-spot short-term payment plan for eligible transactions.

Upon acceptance the member would receive an unsecured loan account with an immediate disbursement posted to the checking account. You could even elect to have the system set up an automated AFT according to your desired payback terms. (Remember that while the system must handle these as loan account suffixes, you can set up any terms you like, including a 0% rate, and call the accounts anything you like.)

Status: Specs are in process.

1Click Refi Offers

The CU*BASE LOS includes a tool that loan officers can use to look for opportunities to refinance loans that their members have under a different financial institution. This feature compares rates from a member’s credit report trade lines to similar CU products, and highlights opportunities the CU might want to pursue with the member.

The 1Click Refi Offers project will use a similar mechanism to extend refi offers to members directly in online banking.

CUs will be able to configure settings for determining whether a member is eligible, either via their CLR Path score, or using standard exclusions such as minimum credit score, age and delinquency exceptions, etc. There will also be a setting for the minimum rate deviation that would be needed in order to present the offer (i.e., if our rate isn’t at least x% lower than the rate on the trade line, don’t bother). We’ll also include a risk-based pricing evaluation when doing the price comparison, choosing the member’s rate based on a recent credit score.

Status: Still in the early design concept stage.

1Click Unfunded Loan Offers

In the 24.05 release we introduced this new type of 1Click Offer that allows CUs to present pre-approved loans to members via online and mobile banking. Future enhancements we have planned for this exciting new product:

- Allow a CU to specify multiple dealers for the offer, then let the member select from a drop-down list of dealers (using our existing Indirect/Dealer database).

- Allow a member to pick one dealer but if they can’t find a car at that dealer, let them cancel that offer and start again with a different dealer.

Status: Implemented in the 24.05 release!

Digital Card Issuance (DCI) for 1Click Credit Card Offers

See the separate Kitchen recipe for details about this project.

Show My Offers – New Online Banking Module

Currently all 1Click Offers are presented to members via the Member Message feature that appears as a scrolling graphical island at the top of the It’s Me 247 home page. While we will continue using this mechanism, we’re also creating a new “Show My Offers” module that will aggregate all pending offers available to a member and display them in one place.

This feature will be launched with the 1Click Relationship Offers project, but will also be used for the 1Click Pay Over Time and 1Click Refi Offers features as well, since all of them require the system to perform an on-the-fly evaluation of the member to determine eligibility.

Status: In process along with the 1Click Relationship Offers project (#62620).

Miscellaneous 1Click Enhancements

- 1Click Offers Expiration Date – Add an expiration date to all 1Click Offers programs, and change the current monthly purge process to be performed daily based on this expiration date. Status: Project #64423 (the same project where we’re creating the new tracking table) is in process.

- 1Click Processing Fees included in Modified APR – Automatically incorporate the processing fee (if applicable) in the modified APR calc for printing on disclosures. Status: Project #60719 is currently in QC testing.

- Allowing Members to Choose a Smaller Loan Amount – Add a way for members to choose the exact amount they want, up to the maximum allowed by the offer. For example, if your offer is for a $5,000 LOC, members could choose to accept a $2,500 LOC instead. Status: Will be introduced with the 1Click Relationship Offers project (#62620) then gradually added to other 1Click types later.

- Assigning Account Suffixes for 1Click Offers – To avoid reusing recently-used account suffixes when members accept a new 1Click Offer. Status: Project #61773 was implemented in June 2024.

- Batch Delete for 1Click Offers – A new tool so that we can easily delete a batch of 1Click Offer records based on a date range. Mostly for those “oops” moments when an offer goes out with a wrong rate or other detail, to eliminate tedious one-at-a-time manual deletions. Status: Project #63603 is waiting for available programming resources. In the meantime, if you have an urgent need to delete a batch posted by mistake, the Lender*VP team does have access to a method to assist.

Other Lending Projects We’re Working On

Did you know…? New integrations for CU*BASE for Ready-to-Look (R2L) LOS Solutions, Ready-to-Book (R2B) LOS Solutions, and Misc. Coverage Solutions are in process all the time. Contact our LOS Coordinator Tom Heidenga to see what’s cooking now!

CLR Path Enhancements

Based on feedback from clients we’re considering adding more criteria to the CLR Path Decision Advisor, including:

- Number of NSFs a member has had

- Negative account balances over a period of time

- Are they signed up for OLB?

- Are they an active debit card user?

Status: Project #64893 is currently waiting for available QC tester. It adds configuration options for more than XX loan extensions, deposit accounts currently negative and more than XX NSFs in previous XX months .

Flex Loans Enhancements

We are planning to add e-sign capabilities to the Flex Loans module, so that you can require a member to sign a form in order for the request to be processed.

Status: Project #61482 was actually launched in 2023 but we hit a roadblock and had to go back to the drawing board on a completely new plan. This project introduces a new technique for how to handle multiple e-signers – a stumbling block on many different e-signing initiatives. It’s easy to collect the signature of the person making the request, but for existing loans that have additional signers, we had no mechanism to put the request on hold while we wait for a co-borrower to get the e-sign request and respond to it, nor any infrastructure for the CU to monitor or work those outstanding requests. The project is now in development. What we learn with this project will give us a path to handle multiple e-signers on other types of loan forms, such as 1Click offers in states that have marital property requirements, or even the planned auto-decisioning project where we want to add decision modeling, auto-approvals and fulfillment/DCI to our new online LOS loan applications to make them fully self-service.

Escrow Processing Enhancements

- Pay Escrow Analysis Surplus by Check – Today for surplus amounts over $50, the only choice is to automatically transfer the funds to the base share account. For surplus amounts under $50, the choices for excess funds are to leave the money in the escrow account or transfer to the base share savings account. With this project, the CU will be able to choose to pay the surplus funds via check. Status: Project #58074 is currently waiting for available QC testing resources.

- Create Flat File for Statement Vendors – This project creates a flat file that gathers Escrow Analysis data similar to how data is gathered into a flat file for member statements. The Escrow Analysis flat file can then be provided to a statement vendor (such as Sage Direct) for formatting and printing. Status: Project #60153 is currently waiting for available QC testing resources.

FUEL Decision Model Enhancements

The FUEL decision model is built on application information from CU*BASE and the credit report details being run through the model. To evaluate the applicant, we have always needed to associate a credit pull to get the data needed to say yes or no.

Credit unions using this new model have asked for a solution to avoid having to re-run a credit report when changes are made to the loan terms that require a second decision to be run. To get around that, we have engaged with Sync1 to expand the FUEL model to allow an existing credit request to be used for an additional decision on that same application, without having to pull (and pay for) a second credit report.

Status: Project #61192 is currently in development.

Online Loan Application

Employing the APIs already in place and in use daily by over a dozen third-party LOS players, we’re creating a brand-new, mobile first online app user experience with a design in sync with our new online banking platform.

First Up: Credit Cards

The first app we will release in late 2024 will be for online credit cards. This will be a companion to the new Credit Card Storefront feature released last summer. In addition to a completely new, modern look and feel, the new app will also include some long-requested improvements to the application data and flow, including changing the way that payments are quoted for credit card products (% of credit limit), using the existing payment due date default from the loan product (to force credit cards to use your standard due date, for example), and collecting co-applicant employer and income details.

NEW! Order the new credit card app now in the store!

Check out the slides from the 2024 Leadership Conference

Watch a demo of the new app from the 2024 Leadership Conference

Next Up:

We are already at work on the second app, which will be a secured loan app you can use for auto and other vehicle loans which include collateral. We’ll be allowing you collect additional information about the collateral (such as make and model, trim package, VIN, mileage, etc.), plus adding a new “I’m still shopping” feature so the member can tell you what they are looking for if exact collateral information isn’t available yet. After that we’ll make minor tweaks to the credit card app to create a new generic app for unsecured loans and LOCs, as well as a new app for secured loans with more generic collateral handling features. Each will have its own customizable storefront vi the Loan Manager.

Status:

- Project #58515 has been completed and includes Loan Manager and the new look and feel option for the existing app, completed in 2023.

- Project #61760, #61332, and #61333, which introduced the new credit card application, were implemented in December. Find it in the store.

- Project #61131, #61334, and #61335 will introduce a new vehicle loan app. Currently in QC testing.

- Project #65441, #65442, and #65443 will introduce a new unsecured loan app. Currently in development.

- Project #65733 and #65734 will introduce a new secured loan app. Currently in development.

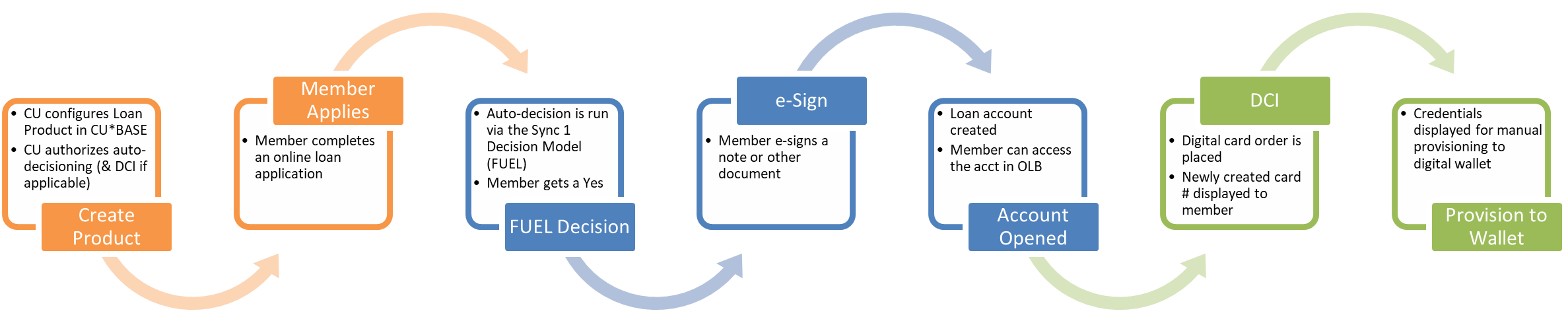

Online Loan App Auto-approvals and Fulfillment via FUEL Decisions

This project combines the mechanisms created for 1Click Loan Offers with the new online loan application UI to allow for auto-approval & fulfillment of closed-end signature loans, unsecured LOCs, and credit cards. An authenticated member would be able to apply for a credit card or unsecured loan via online banking, and when the app was submitted the system would immediately run it through the FUEL Decision Model via Sync 1. If approved, the online LOS would automatically present documents for e-signature and open the account, using the 1Click Loan Offers flow and infrastructure.

Although the behind-the-scenes mechanisms would be borrowed from 1Click, these would still be separate from 1Click offers in that a different configuration would come into play. These apps would still require a member to apply for the loan, as opposed to the credit union creating a list of pre-approved accounts to which an offer would be presented. A CU would not need to set up 1Click offers in order to use the auto-approval and fulfillment flow. But if a form was programmed for use with 1Click offers, that same form could be plugged into the config for a loan product set up for auto-approval & fulfillment.

In fact, a combination of both 1Click offers and the more traditional loan app flow will give credit unions wider reach than just one or the other channel would by itself. Some members might be missed in a batch offer but would still be eligible to get a loan should they apply.

And to put the cherry on top, once the separate Digital Card Issuance project is completed, DCI will also be integrated into the 1Click Credit Card Offers flow so that the member would automatically receive a digital card # and the order for a plastic placed by the system with no employee intervention needed.

Status: Product design is coming along but this project is dependent on pieces and parts from other projects that are still in development, so design work will continue for a while yet.

Chefs for these recipes: Ashley Melder, Dawn Moore, Karen Sorensen