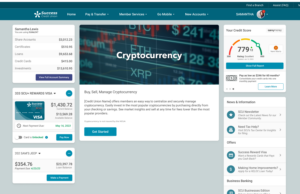

This project develops an SSO option for members to click a link in online banking and jump to a site provided by InvestiFi (formerly CryptoFi) for buying and selling cryptocurrency. This interface could be used by any credit unions who elect to activate a relationship with InvestiFi.

Project champion: Frankenmuth CU

Status as of October 2024: Infrastructure was implemented with the 23.10 release, and Frankenmuth CU is live and using the integration with their members. A Store tile will be created soon, but in the meantime, reach out to Keegan Daniel and the Earnings Edge team if you’d like to learn more!

Project Components

- An SSO link in online banking that gets the member over to the InvestiFi site.

- A back-end (native) integration that allows for funds to be pulled from member accounts and deposited to member accounts when the member requests to buy/sell cryptocurrency.

Single Sign-on in Online/Mobile Banking

We will develop a simple landing page module (look/content TBD) with a button to initiate the SSO.

We will develop a simple landing page module (look/content TBD) with a button to initiate the SSO.

- The module will be available for both It’s Me 247 online/mobile banking and BizLink 247 business online banking

- Location of the link can be customized via CU Publisher

- Enrollment is all on InvestiFi’s end:

- Member signs an agreement

- API from CU*BASE to provide as much member information as possible, member will complete any additional fields we can’t provide

- In this phase there will be no indicator on CU*BASE as to whether a member is enrolled for InvestiFi

- When the member clicks the link, InvestiFi’s user interface will launch

- If a member wants to buy or sell, an API will call for account suffixes for funds to be pulled/deposited, with available balances

CU*BASE Configuration

- A new configuration will be created, accessed via an OPER tool, to include:

- A global activation flag

- Settlement G/L account

- Transaction descriptions (for member and G/L) and other details needed by the interface APIs

- Account types that members can use for transactions (AplTyp SH and SD only at this point, no IRAs or HSAs; future phase could be at DivApl level)

- A new origin code will be created for these transactions

- This will make it possible for CUs to track activity via Query; this phase will not include any dashboard or other tool-based mechanism for this tracking

The Native Integration

- Integration uses a “good funds” model where funds are moved immediately out of or into a member’s account, through a settlement G/L account defined by the CU

- Does not require a CU account like with Freddie/Fannie

- Settlement is manual between the CU and InvestiFi

- Settlement once per business day (cutoff is noon)

- InvestiFi provides reports to the CU for all transactions

- Net amount is settled by the CU sending/receiving funds directly with the Custodian account

- Will all be manual to start (CU uses a wire, ACH, etc.) – future phase may include more automated settlement

Other Caveats

- With this interface your credit union will be working directly with InvestiFi to handle member enrollments and daily settlement activities. Given the risks inherent with cryptocurrency, your credit union will need to be very hands-on, and any interested CUs should do careful due diligence on the features and controls offered by InvestiFi. Our interface is pretty basic: we hand the member off to a third party with which your credit union will have a very close relationship.

- This phase will not include any mechanism for tracking enrollment or member activity, other than a Query of the transaction files using the new origin code.

- Since we won’t be aware of a member’s enrollment status, this phase will not include any changes to our membership closing process to provide a warning about enrollment. Likewise, this phase will have no mechanism for preventing a member from enrolling (other than blocking them from using online banking altogether). Both could be addressed various ways in a future phase.

- There will be no member fee mechanism; however, since transactions will have a unique origin code, CUs could choose to implement a transaction service charge program if desired.

- If the member closes their membership with an active balance at InvestiFi, CU must make arrangements for the member’s crypto balance to be sold. The CU would need to inform the custodian of this closure.

- NOTE: This is an advantage since our integration is essentially a closed loop between InvestiFi and your credit union and your member data. The only way a member can get to InvestiFi is via the SSO, and they cannot post a transaction that moves money out of that loop.

- NOTE: We will also be adding a mechanism where you can block a specific member from being able to access the SSO altogether. This makes use of a special UDI Custom Membership field you’ll set up in CU*BASE. (InvestiFi also has its own set of controls where you can specify, for example, that no members under age 18 can enroll, etc.)

- Since the SSO handles authentication, the member will not have a way to access their crypto funds without logging in to online banking.

- If the credit union elects to end their crypto program altogether, a process will be needed for the members to access their funds via another channel. This is handled between the CU and InvestiFi / Custodian; nothing for CU*Answers to do.

- All fraud monitoring is between the CU and InvestiFi / Custodian; nothing for CU*Answers to do.

Your chef for this recipe: Keegan Daniel